At the end of every quarter, HDB publishes the latest Public Housing Data findings based on transactions from the past quarter. This gives prospective buyers and current homeowners useful indicators on where the market is heading.

Here’s everything you need to know about the latest findings:

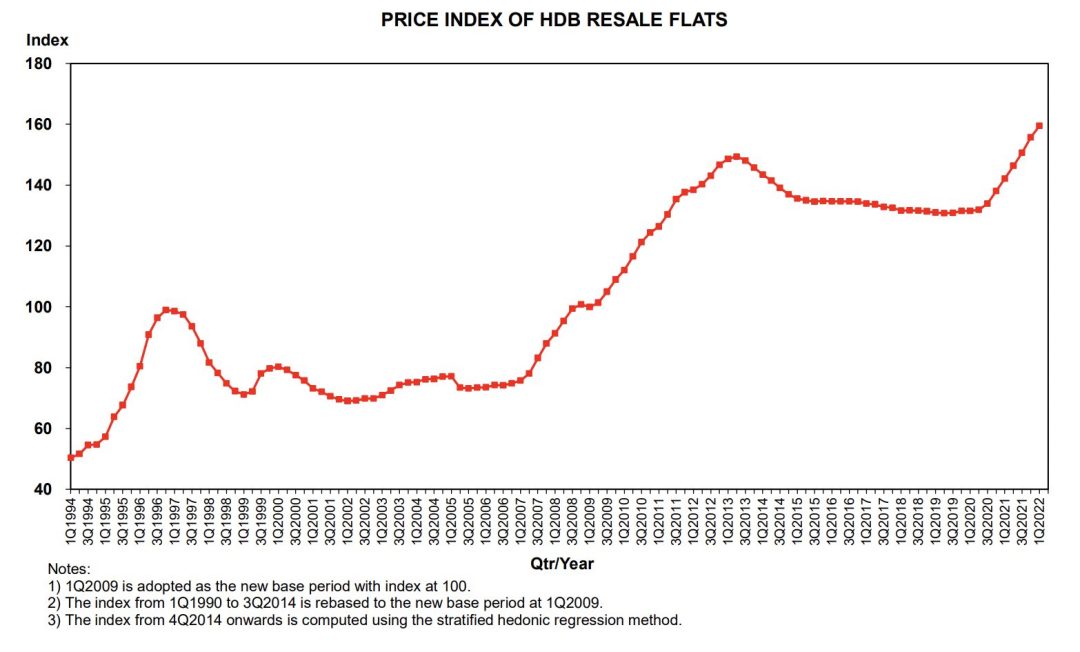

Continued Upward Trajectory of HDB Resale Prices

For the first quarter of 2022, the HDB Resale Price Index – which tracks the median transacted prices across all HDB resale units – saw an increase of 2.4% from the previous quarter.

This continues the upward trajectory of HDB resale prices since 2020, although it seems like the percentage increase has somewhat slowed. This is very likely the result of two main factors: first, the effects of property cooling measures introduced late last year setting in, and second, the market’s reaction to looming inflation jitters which causes people to be more judicious or hesitant about dropping large sums of money for big purchases like property.

Image adapted from: HDB

Image adapted from: HDB

Across different unit types, the estates that saw the highest median resale prices were in mature estates like Queenstown, Geylang and Toa Payoh, although it was surprising to see younger estates like Punggol and Sengkang make the list for 3-room resale units.

This might be due to many of such HDB units in newer estates finally hitting their MOP, and thus more sales transactions in their vicinity.

Highest median resale prices:

- 3-room: Central ($430,000), Punggol ($411,000), Sengkang ($406,000)

- 4-room: Queenstown ($820,000), Central ($811,000), Kallang/Whampoa ($755,000)

- 5-room: Queenstown ($952,000), Toa Payoh ($875,000), Geylang ($856,000)

Image adapted from: HDB

Image adapted from: HDB

Lower Volume of Transactions

Even though prices still rose in the first quarter of 2022, the overall volume of transactions fell by 12.7% from the last quarter. Compared to the same period last year, there were 8.5% less transactions. For this quarter, demand for 4-room resale units saw the highest demand, followed by 5-room and 3-room units.

Image adapted from: HDB

Image adapted from: HDB

While it might still be too early to tell, this trend might signal a dropping demand for HDB resale units. Previously, such resale units were popular because first-time homeowners preferred them to BTOs, given how the latter faced many uncertainties and construction delays caused by the pandemic. After all, newly-married couples would want to move into their new home almost immediately after marriage, as compared to having to wait over 3-4 years for a new BTO.

Despite the wait for BTOs being over 3 years, they remain popular among buyers.

Despite the wait for BTOs being over 3 years, they remain popular among buyers.

Image credit: @jervdesign

However, as the world moves out of pandemic mode and countries are more or less open, the construction industry would see a much-needed recovery in terms of workers and materials coming into Singapore. In turn, fewer delays for upcoming BTOs will result in more first-time buyers would be drawn back to the BTO market.

New BTOs in 2022

Rounding off the latest news is the announcement on upcoming BTOs for 2022.

In May, applications will open for about 5,300 BTOs in Bukit Merah, Jurong West, Queenstown, Toa Payoh and Yishun. We’ve covered all you need to know about the May 2022 launch, so be sure to check that out.

UrbanVille @ Woodlands is one of the BTO projects slated for completion in 2026.

UrbanVille @ Woodlands is one of the BTO projects slated for completion in 2026.

Image credit: MustShareNews

Later in August 2022, there will be an additional 6,300-6,800 BTOs launched in estates like Ang Mo Kio, Bukit Merah, Choa Chu Kang, Jurong East, Queenstown and Woodlands. Of course, all this is subject to review by the HDB, and more details will be out closer to the date!

Movement of HDB Resale Units

So what does this mean for first-time homeowners or those looking to upgrade/downgrade to a resale HDB unit in the future?

Well for one, many expect the median price (i.e. Resale Price Index) of resale units to hit some form of resistance in the near future, as demand slowly shifts away from resale units to either BTOs in hot locations like the Greater Southern Waterfront, or towards ECs or private condo launches. This would spell good news for those who are looking for resale units, as they won’t face the prospect of sky-high prices caused by huge demand.

The demand for jumbo flats has seen prices reach unprecedented heights.

The demand for jumbo flats has seen prices reach unprecedented heights.

Image credit: 99.co

That being said, there will also be those gunning for rare HDB units such as jumbo flats and mansionettes, so we can still expect to see some form of sustained demand for HDB resale units, especially in those older estates.

Of course, check out our comparison guide between BTOs and Resale Units – hopefully you’ll get some clarity on which one works best for you.

Cover image adapted from: MustShareNews, HDB

Drop us your email so you won't miss the latest news.