One of the biggest perks about buying a resale flat instead of a BTO is the luxury of choosing its location. That’s why estates like Clementi and Central often lead the pack when HDB announces the median resale prices every quarter, with Q2 2022 no different. On the other hand, estates further from the heart of Singapore trade off their further locale for affordability.

Over the weekend, HDB released some numbers about how the resale market performed in 2022’s second quarter and the trends are pretty eye-opening. Let’s take a look at what you can expect about the housing market coming into the second half of 2022.

Clementi & Central have the most expensive resale flats on average

Image credit: TheSmartLocal

As expected, Clementi and Central are 2 estates that have resale flats hitting quarterly highs. Their proximity to the CBD – with Central literally being a part of it – makes them attractive neighbourhoods to live in, especially for younger couples who work in town and appreciate the shorter daily commute. They are also mature estates, which means more and better facilities like accessible MRT stations and whatnot.

For 5-room resale flats, Clementi is the only estate that has a median price of $900,000 in Q2 2022. This is a significant increase over Q1 2022 when the median resale price for the estate was $818,000. It helps that there were 7 5-room flats that sold for over $1M in the area. This price is expected especially for flats with at least 90 years remaining on their lease.

Image credit: TheSmartLocal

For 4-room resale flats, Central took the top spot as usual thanks to The Pinnacle@Duxton, which brought the median resale price up to $964,000 in Q2 2022 compared to $811,000 in Q1 2022. With more 4-room flats going for over $1M compared to the previous quarter, it’s no wonder that the prices have increased significantly.

Other estates have also been making waves this past year like how Queenstown is home to the most expensive resale flat that was sold for $1.41M, although that took place in July.

Woodlands remains the most affordable estate for 4- & 5-room flats

Image credit: TheSmartLocal

Located all the way in the Northside of Singapore is Woodlands, which remains one of the more affordable estates to buy a 4- and 5-room resale flat. In Q2 2022, the median resale price in this non-mature estate for a 4-room flat sits at $450,000, while a 5-room’s median selling price is $545,000.

The relative affordability of homes in Woodlands also means that more buyers are interested in the area. There were 190 4-room flats sold from April – June 2022, with the cheapest flat going for $328,000 while the most expensive was only $588,000.

If you don’t mind compromising the price for the location, then Woodlands might be one place to seriously consider when the time comes to buy a flat. It’s also easier to make a quick trip up to JB over a long weekend with the causeway just right around the corner.

Other estates with resale flats around a similar price point include Bedok, Sembawang, and Yishun. A common theme between all of these estates is that they’re all located on the fringe of Singapore.

Analysing Singapore’s housing market for the rest of 2022

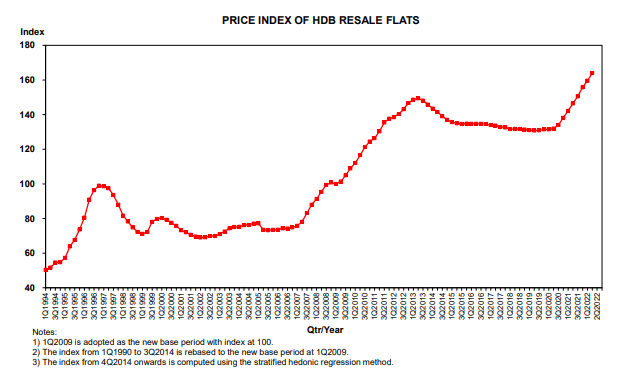

Image credit: HDB

While the price index of resale flats is on the up and up, there is no need to fret just yet. Sales of resale flats have been on a steady decline over the last three quarters – there were 6,934 sales in Q1 2022 and 6,819 sales in Q2 2022. If the trend continues, it might indicate that the market is slowly losing momentum.

With many more flats set to hit their MOP in 2022, median prices of HDB resale flats might remain stable in the second half of the year or even show a slight dip if the supply outpaces the demand. Rising housing interest rates and quicker BTO construction times might also have families and couples looking at those options instead, too.

Read similar articles:

- Best housing estates for newlywed couples

- Amazing 5-room resale designs under $45K

- Guide to HDB housing grants

Cover image adapted from: TheSmartLocal

Drop us your email so you won't miss the latest news.